The rise of the “prosumer” in China and its effect on the poultry powerhouse

For the Chinese, the rooster symbolizes vitality, honesty, integrity and luck, but what meaning does the Chinese poultry industry have to the world?

“China is different and is not for the faint-hearted,” said Dr. Mark Lyons, executive vice president and head of Greater China for Alltech, during the Alltech Annual Breakfast Meeting at the 2017 International Production & Processing Expo.

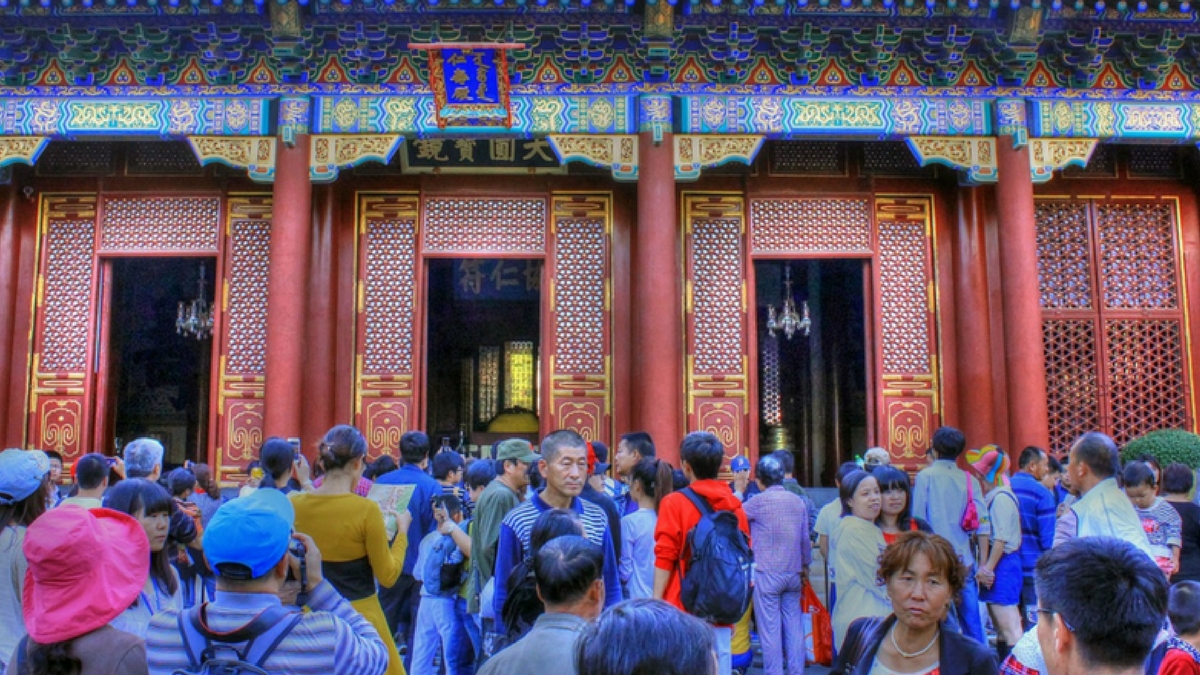

There has been a great urban shift of 300 million people within the economic power player, resulting in 188 cities in China that are larger than Chicago. Additionally, China has a rising middle class that is young, urban and globally minded.

Since the annual Alltech Global Feed Survey began in 2011, China has dominated the world’s feed production, responsible for approximately 35 percent of the world’s total animal feed. In terms of poultry specifically, China is home to 20 percent of the world’s 60 billion poultry birds, including 8.8 billion broilers, 1.2 billion layers/breeders and 4 billion waterfowl. Currently, China produces 26 percent of the world’s poultry meat, and studies show that both consumption and production of poultry will continue to increase in China, and worldwide, over the next 10 years. China is also the world leader in egg production, producing almost six times more than the United States, which is in second place.

Poultry trends in China

- Both the poultry and egg industry are moving toward integration.

- Consumer awareness of environmental pollution is growing and creating pressure at the farm level.

- Antibiotic-free production is a growing trend as testing and legislation increase.

- Pressure from the cost of feed materials is rising.

- Desire for high-quality poultry products is increasing.

Challenges within China’s poultry sector

- High feed costs; up to two times the cost of international prices

- Flat consumption, as chicken meat is considered an inferior protein to pork, seafood and beef

- Falling exports, as China’s competitiveness is decreasing against Brazil and Thailand to its top export market, Japan

- Disease, with avian influenza outbreaks harming the image of poultry meat with consumers

“We have been talking about the power of the new consumer, which we are calling the prosumer,” said Lyons. “I believe there are more prosumers in China than any other market in the world today.”

Rather than simply consuming products, these prosumers are proactively exhibiting their beliefs, ethics, standards and aspirations through their purchases. Prosumers are product and brand advocates who now significantly affect the success or failure of companies, products and brands through their involvement on social media outlets. Poultry farmers around the world need to build relationships with these new consumers, and, as a poultry powerhouse with the largest rising class of prosumers, China may lead the way.

Have a question or comment?

- Read more about The rise of the “prosumer” in China and its effect on the poultry powerhouse

- Log in to post comments

<!--[if lte IE 8]>

<script charset="utf-8" type="text/javascript" src="//js.hsforms.net/forms/v2-legacy.js"></script>

<![endif]-->

<script charset="utf-8" type="text/javascript" src="//js.hsforms.net/forms/v2.js"></script>

<script>

hbspt.forms.create({

portalId: '745395',

formId: '7046e5d7-6668-42e6-953d-45ac02f6a192'

});

</script>

<p>China is not only home to 25 percent of the world's poultry meat but also the largest rising class of prosumers.</p>