Andrew Meadows - Coronavirus, consumers and citrus

As consumers rush to stock up on staples, orange juice has made its way to the top of the shopping list. How will the coronavirus crisis impact an industry that has been pummeled by hurricanes and citrus greening? Andrew Meadows, director of Citrus Mutual in Lakeland, Florida, shares his insights on how shifting consumer demands will impact the market now and in the future.

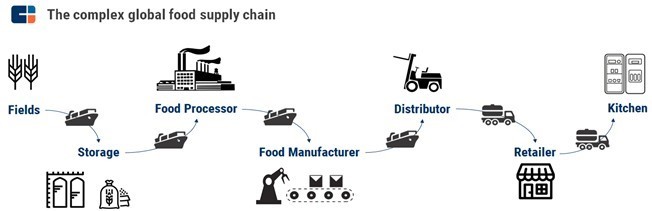

This episode is part of a special AgFuture series on the impact of COVID-19 on the food supply chain. Join us to hear how those on the frontlines of the global pandemic are working to overcome adversity and feed the world.

Hosted by Michelle Michael

As lead video producer at Alltech, Michelle travels the globe for the company’s award-winning Planet of Plenty™ documentary series. Michelle spent a decade as a video producer/reporter in Germany, reporting from military hotspots at the height of the war on terrorism. The National Press Photographer's Association (NPPA) has twice recognized Michelle as their solo video journalist of the year.

Co-produced by Brandon Whitworth

As the senior media production specialist at Alltech, Brandon co-produces the company’s award-winning Planet of Plenty ™ documentary series. Brandon is a two-time Emmy Award winning television news photojournalist and three-time nominee. He has received several regional awards from the National Press Photographers Association for excellence in visual storytelling.

The following is an edited transcript of Michelle Michael's interview with Andrew Meadows. Click below to hear the full audio.

Michelle: Hello! I'm Michelle Michael. In this special series of AgFuture, we're talking with those working along the food supply chain about the impact of COVID-19. My guest today is Andrew Meadows, director of Citrus Mutual, based out of Lakeland, Florida. Citrus Mutual is a nonprofit trade association that acts as an advocate for citrus growers, particularly when it comes to economic matters. Andrew, thank you so much for joining us today.

Andrew: Thank you very much for having me.

Michelle: Hope you and your family are safe right now in the midst of this pandemic. It's a scary time. We're all learning to navigate this new norm together, and it's the same throughout agriculture. I'm hearing that orange juice is suddenly a hot commodity. In fact, I've heard there's been a significant jump in sales as the demand for vitamin C goes up. Do you have numbers that confirm that?

Andrew: Yes, we measure orange juice sales. Our industry here in Florida is (that) 95% of our product, our oranges, go into juice. The remaining 5% is the fresh table market. But we, as an industry, measure our sales in four-week increments. We work through Nielsen Incorporated, which is a well-known consumer data company. Actually, the last four-week period was March 14, and it showed an increase at retail of 10%. Although this situation is a crisis, and I hope everybody out there is staying safe and doing what the CDC recommends, it is heartening to us, as an industry and our growers, that people still see orange juice as a significant source of vitamin C, which, of course, can help boost and support a healthy immune system. We'll get numbers in mid-April for the next four-week period, and we expect those to be up as well. Anecdotally, we're hearing from our processors that sales are continuing to be up. Although the country is grappling with this crisis, the silver lining, I guess, for our growers is that people are looking to orange juice for vitamin C.

Michelle: Of course, we have to say that there's no evidence that vitamin C is effective against coronavirus, but people certainly are looking to increase their vitamin intake. That's a very real thing. Can you describe what you're seeing in the public there? Do you see orange juice flying off of store shelves, just like you see toilet paper disappearing?

Andrew: Well, I don't think we've gotten as much publicity as the toilet paper issue, or bottled water or bread, those sorts of staple items. But anecdotally, I always keep an eye on the frozen section when I go to the grocery store, and there have been some empty shelves where, normally, they front their inventory. So, I've seen it. The numbers back it up. Again, as you mentioned, there's not a direct effect on coronavirus itself, but certainly, vitamin C supports a healthy immune system, and that's what people are looking for now. Traditionally, our sales do spike during the cold and flu months, November to February. We heavy-up our advertising and marketing during that period, historically, but of course, with people falling sick now to this new disease, that's only supported more interest in orange juice and vitamin C.

Michelle: Andrew, what about packing lines? Can the pack houses keep up with this sudden increase in demand? Or is the demand outpacing the current supply? And should consumers be worried that orange juice and oranges are going to disappear from store shelves?

Andrew: I don't think it's to that point. We have seven major processing plants here in Florida. They are all working extremely hard, is what I'm being told. I don't think we're to the point where our supply chain can't meet the demand that's out there. But, certainly, they are working hard, and we're getting our late-season Valencias to the processing plants as fast as we can at this point.

Michelle: What about moving products once they’re actually packaged? Are you finding that there are enough truck drivers out there to move the product and respond to this new increased workload?

Andrew: Again, I haven't really pursued that. I haven't heard anything from our contacts and the meetings that I have that there has been any sort of distribution issues at this point. I don't think we're at that point, and (I don’t think) that much stress is being put on the supply chain. I haven't received or heard any information on that front.

Michelle: Citrus is, of course, harvested by hand. Can you talk specifically about what precautions are in place to keep people safe during this pandemic?

Andrew: Yeah, we're a critical industry. We've been deemed a critical industry from the federal government on down, and, of course, our state ag commissioner, Nikki Fried, has determined us to be a critical industry, as well as our governor, Ron DeSantis. We have people going to work. We were under strict food-safety guidelines prior to this virus and this pandemic hitting, so there are very stringent state and federal food-safety guidelines: hairnets, gloves, sanitation. Those sorts of things are already very much in place in our industry. Each individual packing house or processor are taking their precautions, whether it's social distancing, requiring washing of hands, even above and beyond what the regulations require. Some employers are using masks, employees wearing masks. We're used to the food safety and hygiene issues, being a food industry. I think those have actually been amped up in this environment. We're doing all we can to get a healthy, safe product out to consumers right now.

Michelle: This pandemic has just been a terrible thing for everybody. At this time, it's hard to talk about opportunity, but right now, really, in the citrus world, this is a tremendous rebound. For at least a decade, citrus growers have battled citrus greening. That's a disease, of course, that's killing the world's orange trees, and growers really struggled financially over the last several years. What does this new uptick in sales mean to growers? Is it a rebound of sorts?

Andrew: It's big. I mean, it's mixed emotions, of course. We aren't looking to capitalize on a crisis situation. But certainly, with the consumption numbers falling over the last, really, decade and a half, I can't tell you anything other than it is good news. We are encouraged that people still see orange juice as a healthy drink, that's clear, and a source of vitamin C. It's mixed emotions. It's big, yup. HLB, or citrus greening, has ravaged our groves. Our production has fallen from 240 million boxes 15 years ago to about 70 million boxes of oranges. Those are 90-pound sealed boxes. You can see the production. Now, not all of that is due to greening. We've experienced hurricanes, of course, real estate pressure, other diseases, but a big part of it is because of greening. The fact that we've shown, year over year, increases in this first four-week period is encouraging. But again, it's mixed emotions because it is on the back of this pandemic.

Michelle: How do you see the future of citrus going forward? The next five years, for example: Will this habit of people going after vitamin C continue after this pandemic is over?

Andrew: I think it will. I think it's let the cat out of the bag. I think our marketers will take advantage of it. I think that we're going to be here to stay on a consumption side, and we'll rally. We've got optimistic growers out there. Our acreage isn't the same, our production isn't the same, but the men and women who remain in the industry are in it for the long run. We don't have gentlemen farmers or hobbyists or people who aren't doing this as a full-time job. We've got the best and the brightest growers. They're well-schooled in economics and science and meteorology. It's really — you have to be a jack of all trades now to be a citrus grower.

We're cautiously optimistic. We think that we've learned — through nutritional programs, through new rootstocks, through different production techniques and encouraging root health and the proper irrigation pH in our irrigation water — that we can produce quality oranges and grapefruit and tangerines, even with this immense disease pressure from greening. So, we're cautiously optimistic. If you're not cautiously optimistic, you probably shouldn't be in agriculture, because it is a difficult profession.

Michelle: Outside of the citrus industry, what are you seeing where you're located? How are other crop farmers faring during this crisis? Tomato growers, for example, watermelons — what are you seeing and hearing as you talk with so many others around your state?

Andrew: Yeah, everybody is challenged. They are also out there and experiencing support because of the health benefits of fresh winter vegetables. Our winter harvest for those commodities is pretty much over. That comes and winds down in March and the end of March. As far as the direct effect, we're winding down those harvests of those crops. But again, there are trade issues out there. We want to be protected. Our winter fruit and vegetables want to be protected in any new trade deals with Mexico. They're a huge competitor. That's weighing heavy on the minds. The U.S. Trade Representative recently canceled some public hearings that were going to take place in the next week where we were going to, as an agriculture industry — not just citrus — weigh in and make sure that there are protections over dumping and unfair trade practices and that sort of thing. So, we'll be looking to have that rescheduled when the curve gets flattened on this pandemic.

Issues like trade are still (going to be) weighing heavily when this all gets cleared up. As they always do, we'll get back to business, but it's, again, a way of life, and it’s agriculture, and there are always issues. Thank goodness organizations like Florida Citrus Mutual and the Florida Fruit and Vegetable Association and the Florida Farm Bureau are out there advocating for growth.

Michelle: It's a challenging time, learning to navigate this strange new world that we live in. But in such a time, do you feel that the general public is perceiving agriculture in a new way, a better way — perhaps (feeling) even more grateful to growers, to farmers around the world?

Andrew: I absolutely do. I think that people are more and more concerned with where their food is grown. They understand and are becoming more educated that it doesn't originate in the grocery store. I think, especially here in Florida, where there's high population growth, that green space is coveted, and agriculture is seen as green space, wildlife habitat, water recharge. I think people have come around in the last 10 years to 15 years and appreciate agriculture that much more and understand the good work that farmers do.

Michelle: Andrew Meadows from Citrus Mutual in Florida, thank you so much for joining us today.

Andrew: Great. Thank you very much for your time.

Michelle: For additional resources on COVID-19, visit Alltech.com.

Click here for additional COVID-19 resources.

Andrew Meadows is heartened to know consumers still see orange juice as a significant source of vitamin C and claims about 95% of Florida's oranges are used to make juice.